Premier Offshore Business Administration Solutions

In today's international business landscape, overseas firm management options have come to be an essential part of numerous organizations' operations. With the potential to enhance performance, reduce prices, and enhance flexibility, top offshore services use various advantages for organizations looking for to broaden their visibility beyond boundaries. From streamlined operations to guaranteeing conformity with international laws, the essential features of overseas company management are created to support business in attaining their critical goals. Choosing the best offshore monitoring service provider is crucial for success in this complex and swiftly evolving field. In this discussion, we will certainly explore the benefits of top offshore remedies, dive right into the crucial features of overseas company administration, and provide useful understandings on choosing the appropriate company to meet your organization's unique requirements.

Advantages of Premier Offshore Solutions

Premier offshore services provide a variety of significant advantages for services and people seeking reliable and safe and secure administration of their offshore firms. One of the key benefits is the improved personal privacy and privacy that these remedies provide. Offshore territories usually have rigorous policies in area to safeguard the identification and details of company proprietors, guaranteeing that their monetary and personal details continue to be personal.

Additionally, leading overseas solutions use tax obligation optimization chances. Several overseas territories have desirable tax regimens, enabling business to reduce their tax obligation responsibilities lawfully. This can cause considerable price savings and enhanced revenues for organizations operating offshore.

Furthermore, premier overseas remedies supply asset defense advantages. By developing an offshore firm, businesses and people can legitimately divide their personal and organization properties. This provides an added layer of defense versus potential suits or creditors, securing their wide range and guaranteeing its lasting preservation.

An additional advantage of premier offshore remedies is the flexibility they use in regards to worldwide service operations. Offshore firms can be utilized for worldwide profession, financial investment, and holding functions, giving people and companies with the ability to broaden their operations and get to new markets.

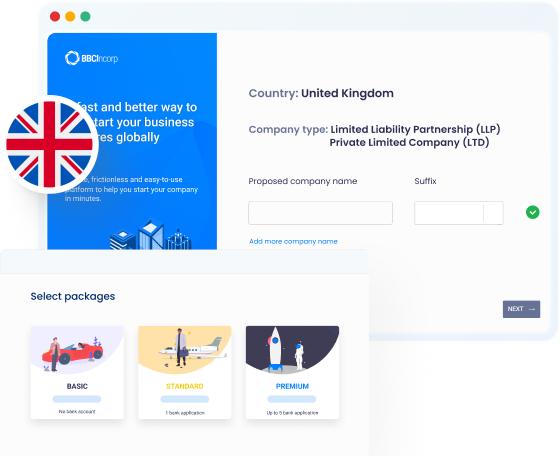

Finally, top offshore services often use effective and streamlined business development and monitoring procedures. Offshore jurisdictions have actually created durable frameworks and framework to promote the facility and administration of companies, allowing swift and problem-free procedures.

Key Attributes of Offshore Firm Monitoring

When it comes to overseas business management is comprehending the essential features that make it a viable alternative for companies and individuals,One crucial facet to take into consideration. Offshore company administration offers a number of crucial functions that make it an appealing choice for those looking for to enhance their company operations.

One trick function is the capacity for tax obligation optimization. Offshore jurisdictions typically provide positive tax obligation routines, enabling business to legally minimize their tax obligation liabilities. This can lead to considerable cost financial savings and enhanced success for companies.

Another vital function is property protection. Offshore territories usually have robust legal structures that protect the properties of individuals and organizations from potential threats such as lawsuits or financial institutions. formation of offshore companies. This can offer a greater level of protection and peace of mind for financiers and entrepreneurs

Furthermore, overseas firm monitoring frequently supplies enhanced privacy and privacy. Lots of overseas jurisdictions have stringent legislations and policies in position to secure the identifications and financial information of company proprietors. This can be particularly appealing for high-net-worth individuals or companies running in delicate markets.

Selecting the Right Offshore Monitoring Provider

When browsing for an offshore administration company, it is very important to very carefully consider their knowledge and performance history in providing effective and trustworthy services. Picking the best offshore monitoring supplier is important to make certain the smooth operation and success of your overseas company.

When picking a service provider is their know-how in overseas company administration,One of the vital factors to think about. A credible company needs to have a deep understanding of the offshore industry, including understanding of local laws, tax obligation laws, and compliance demands. They must also have experience in taking care of overseas firms throughout various jurisdictions.

An additional vital factor to consider is the carrier's track document in supplying efficient and reputable solutions. Furthermore, take into consideration the company's durability in the market as it can indicate security and reliability.

In addition, it is suggested to evaluate the provider's series of services. A thorough overseas management carrier must provide a vast array of solutions, including firm formation, company administration, accountancy, banking, and lawful support. This ensures that all your offshore firm's requirements can be resolved by a single provider, simplifying the administration procedure.

Streamlining Workflow With Offshore Solutions

To enhance performance and maximize the potential benefits of offshore options, businesses can execute streamlined operations tailored to their specific demands. Simplifying procedures entails studying and boosting every facet of a business's offshore activities, from procurement and look at this now logistics to production and client service.

One way to simplify procedures is by automating hand-operated procedures. By replacing time-consuming and recurring jobs with modern technology, organizations can reduce human error and rise performance. This can consist of utilizing software program remedies for stock administration, order processing, and economic deals. Automation additionally enables real-time data analysis, making it possible for services to make educated choices and react rapidly to market adjustments.

One more way to enhance operations is by implementing standardized treatments and process. By developing clear guidelines and methods, organizations can guarantee uniformity and effectiveness throughout different groups and departments. This can entail creating typical operating procedures (SOPs) for regular jobs, establishing interaction channels for efficient cooperation, and executing efficiency metrics to measure and enhance check this site out operational effectiveness.

Moreover, organizations can enhance procedures by outsourcing non-core functions to offshore service suppliers. This permits companies to focus on their core proficiencies while leveraging the experience and cost advantages of offshore experts. Contracting out features such as IT sustain, accounting, and customer care can lead to set you back financial savings and boosted solution top quality.

Ensuring Compliance in Offshore Firm Monitoring

As services implement streamlined operations in their offshore tasks, making certain compliance ends up being a vital facet of overseas firm management. Conformity describes adhering to all relevant regulations, laws, and plans governing offshore operations. Failing to adhere to these demands can result in legal and economic repercussions, reputational go to this site damage, and loss of organization possibilities.

To make sure conformity in overseas company monitoring, businesses must develop durable internal controls and administration frameworks. This includes developing and applying detailed policies and treatments that deal with key conformity areas such as anti-money laundering, anti-bribery and corruption, information security, and tax laws. Routine audits and threat analyses must also be performed to identify any kind of potential compliance gaps and carry out restorative procedures.

Additionally, business ought to stay upgraded with the ever-changing regulatory landscape by monitoring market growths and joining pertinent training programs or meetings. formation of offshore companies. This proactive technique helps to alleviate risks and make sure continuous conformity

Furthermore, engaging certified professionals with expertise in overseas conformity is vital. These specialists can provide support on governing needs, help in establishing conformity programs, and conduct independent audits to guarantee adherence to lawful and moral criteria.

Conclusion

Finally, top overseas company administration remedies offer various benefits and crucial attributes for enhancing procedures and ensuring conformity. Picking the right overseas administration carrier is important for making the most of these benefits. By eliminating personal pronouns and maintaining an academic writing style, this article has provided an overview of the factors to consider and benefits linked with overseas company management.

In today's international organization landscape, overseas firm monitoring options have become an important part of numerous organizations' procedures. From structured operations to ensuring conformity with global guidelines, the crucial functions of offshore firm administration are developed to sustain firms in attaining their strategic objectives. In this conversation, we will certainly discover the benefits of premier overseas options, dig right into the crucial attributes of offshore firm administration, and offer valuable understandings on choosing the best company to meet your company's distinct needs.

Premier offshore solutions supply a variety of substantial benefits for companies and people seeking secure and effective management of their overseas companies.As services implement structured procedures in their offshore tasks, guaranteeing conformity ends up being an important facet of offshore business monitoring.